Tag Archives: plans 2021

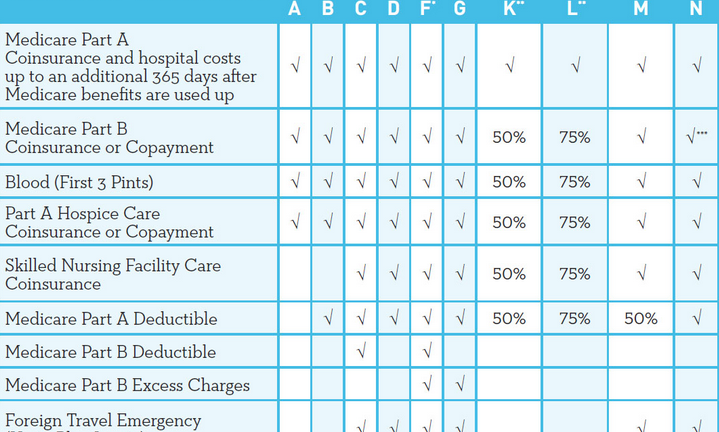

Medicare Supplement Strategies are also called Medigap prepare and it is the insurance policy policy which aids the owners to cover all of the coinsurance, deductibles, co payments and excessive charges which aren’t covered below their original Medicare approach. The plan is currently available for anyone that is already registered to your Section A Part B Medicare options. The Medicare supplement plans 2021 is exceptional and has many new upgrades. It insures many of the copayments, extra charges and also foreign crisis traveling for treatment outside the country. Now you could also buy your Medicare Supplements by evaluating the diverse plans from the Medicare Supplement programs Comparison Chat 2021 which can be found on the web.

Fully guaranteed Acceptance

If You’re turning 65 or already above the age of 65, you are ensured Endorsement in some one of the Medicare Supplement Strategies from almost any carrier provided that you arte enroll in just about any of these Medicare Strategies later you turn 65. You want to be certain that you have already registered for Part A and Part B Medicare approach prior to registering to your nutritional supplement plans.

What is Not Covered by Medicare Approach?

The initial Medicare Programs do not insure a variety of healthcare costs Also to pay the expenses that the Medicare Supplement Plans 2021 are launched. It covers all which are not being covered under your initial Medicare program. All-the out of the pocket expenses not included in Part A and Part B have been covered with the supplement plans. Including:

• Aspect B Deductibles

• Element A Hospital Deductibles

• Co Payments for Healthcare Facility Stays

• Care in skilled nursing facility for more than 20 days

• 20% coinsurance for Medical Costs and physician’s statements

Each of the standard nutritional supplements cover these costs and additionally the Cost of foreign traveling for medical treatment away from the country.

A Medicare supplement Strategy Performs with the Absolute Most Essential function within the lifestyles of older individuals. This plan of action is the insurance policy plan. It includes the first Medicare component A and Medical part B in it. When one takes the original Medicare, a few components aren’t covered with it. But Medicare health supplement pays the remaining out portions of this original one.

Each Medicare Supplement plan is determined by a Person’s complete budget savings. Inside this article, we’ll chat about how you’re able to come across the most appropriate Medicare supplement plans 2021 foryou personally.

Know Your coverage, then select the most effective one

Realize That the Medicare Complement strategy will Help the older or those who will simply take it with their money coverage. While the original Medicare will not cover all. Including co insurance, copayments, deductibles, etc..

In the Event You have-

Ø Minimal coverage- You should take Program A. It covers all of fundamental Kinds of substances.

Ø For more protection – You will take Strategy F and G.

Ø Whole protection – Strategies K and L.

Ø National protection – Strategies Do , D, F*, M, N, G.

Locate The optimal/optimally plan based on your financial plan

To comprehend such plans, first, make sure you Understand about your financial plan totally. Then you definitely are certain to get these options rates are set. Three types of price tag processing can transpire.

Ø Age-related- The top pricings come about primarily based on age.

Ø Present age-related- the superior pricing is dependent on the present era.

Ø Group – Members out of an Identical group Must Pay Sam-e The very same value.

Inquire Your own insurance provider about the things they are going to give

Prior to Choosing that Medicare Supplement Options you want probably the most, question around about what they have been offering together with their own plans.

Your Rights

During the Medicare Dietary Supplement open enrollment Period of yours, you can find some good issue legal rights.

Recently, the Centres for Medicare and Medicaid Services (CMS) had Announced the changes in plans for the Medicare advantage plans 2021. These changes include the changes percentage in cost and other significant announcements regarding the enrollment dates as well as durations. If it’s your very first time registering at a Medicare plan, you have to seriously think about all the plans and also consider the selections carefully, as these sort the foundations of your health care support. If this can you’ve had a medicare enrollment, you might know most of the stuff. Thus, it becomes a lot easier for you to understand the difference between the existing and the revised plans.

Medicare Advantage Plans 2021 And Enrollment Periods

Medicare Advantage program is provided by different companies and assist Greatly by blending using the original medicare want to pay for both component A and Part B subsidiary choices. Medicare Advantage Plans 2021 goes to become beneficial considering that the fluctuations in the percentages of obligations. You have to apply for Medicare plans within the registration dates to become eligible for the advantages proposed by it. The registration dates are;

openenrollment Phase

It commences from 15 th October 2020 before 7th December 2020 – Through this age , you may enroll into a new strategy or change off your aims.

Fivestar Registration Programs

Applications only legitimate double – 8th December 2019 around 30th November 2020

Part A and Part B enrollment Period

This can be employed between 1st January 20 20 to 31st March 20 20

Cost Percentage Modifications

Apart from these statements, CMA has additionally declared the fluctuations in The proportion of the payment to get Medicare Advantage Plans 2021.

● Successful growth speed rises from 2.99% to 4.07%

● Average changes to happen in earnings – 0.93percent to 1.66percent

Medicare Advantage plans have assisted folks financially all over the World. They help in providing benefits which aren’t insured with additional Medicare insurance policies. It’s extremely crucial that you cautiously compare all the plans prior to deciding. Usually do not be unwilling to look at the percentage changes in cost. Proceed healthy using all the Medicare Insurance Plans!