Tag Archives: Supplement

Medicare Nutritional supplement Plans are a vital part of the medical care insurance program to pay for a number of the fees which are not included in Initial health care coverage. In this particular blog post, we are going to talk about the way to submit claims for Mutual of Omaha Medicare Supplement rewards. We shall offer several easy methods to have the method as clean Mutual of Omaha Medicare Supplement as possible.

If you are signed up for a Medicare insurance Health supplement Program, you should spend a month-to-month installment. In addition, you will additionally be responsible for having to pay any income tax exception to this rule and coinsurance that happen to be essental to your prepare. Nevertheless, in case you have claims that is protected by your Medicare Dietary supplement Prepare, the insurer will reimburse you for several or all of the charges.

How to document state?

To file a compensation claim for Mutual of Omaha Medicare insurance Strategy N 2023 benefits,

●You will have to distribute a compensation claim kind to the insurance carrier. It is possible to usually find this kind on the website of your own insurance provider.

●Once you have presented the declare form, the insurance company will review it and determine regardless of whether your assert is valid. You need to submit some records, like medical charges, to the insurance company. The insurance company will then produce a transaction to you and your company.

●If your claim is accredited, the insurer sends you with a check out the volume of positive aspects that you are currently qualified for.

Ideas

There are several stuff you can do to produce the statements procedure go far more smoothly.

●Initially, make sure to always keep accurate data of your medical expenditures. This will help the insurance company to determine the level of your assert.

●Next, make sure you submit your claim kind and documents on time. The sooner you distribute your declare, the sooner it will be highly processed.

●Eventually, for those who have any queries regarding the claims approach, make sure to contact your insurance firm. They are able to help you through the approach and answer inquiries that you may have.

Conclusion

Submitting an insurance claim for Medicare Nutritional supplement Strategy benefits might be a basic procedure should you be ready and get all of the essential documentation. By following the following tips, you are able to ensure that your assert is processed quickly and effortlessly.

Excessive weight is among the significant struggles fought by humankind and sometimes requests for many work and devotion to counter-top. In the brand of heal, there have been numerous cases when an individual has brought the wrong set of nutritional supplements or put into practice the wrong diet plan to help impede the entire body. Thus, the complete approach has to be organized properly, and the best supplement would help out along the way. 1 amongst these is Bio melt pro and recently there has been various misconceptions of bio melt pro scam. The forthcoming articles speaks at length bio melt pro reviews upon it.

How come it not much of a fraud?

Listed here are the fundamental reasons for which it may be chucked off from the statements of scam or unacceptable info:

•The compound is created direct away from natural ingredients without the preservatives that often cause harm to your body. Such as Poppy seed products, Corydalis, Passiflora, Marshmallow cause, and Prickly Pear.

•The health supplement operates inside a synchronised trend to get rid of two wildlife with one particular stone- sleeplessness and raising body fat due to the past problem. A similar continues to be tried and tested out before moving in to the business marketplaces.

•They have also battled out of the phases of depression, reduced sensing, and performs towards the uplifting of the disposition.

•The origin of manufacturing is traditional and originates from the verified stage, with guarantees presented on payback.

Consequently, the clouds of bio melt pro scamget removed off by these details that confirm the entire usefulness in the substance.

The final call

Indeed, it is now very easy to conclude that Biography Burn is not really a gimmick and possesses instead turned out to be much beyond that. You may give it a shot to battle out your excessive weight problems and gain the desire thin design. Proceed to the official website and buy out beneath the assistance to find the perfect.

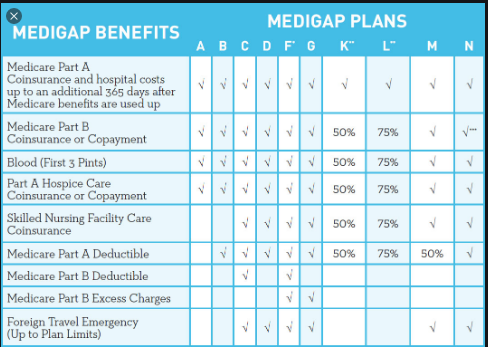

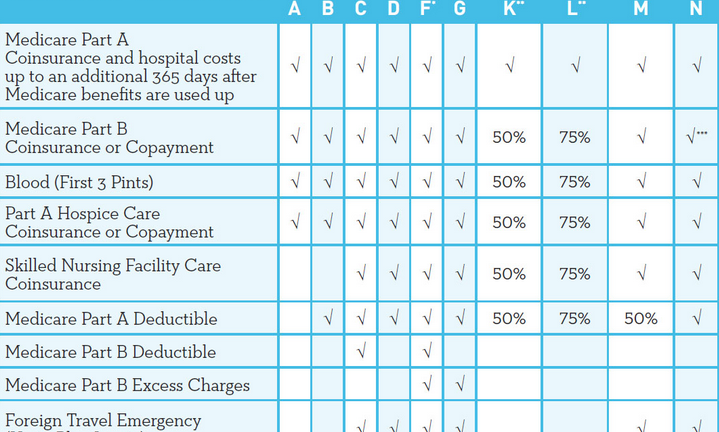

Medicare health insurance is the greatest health insurance supplier for the aged people in excess of 64 yrs. Medicare health insurance Supplement is additionally called a Medigap coverage. Getting the Medigap coverage, any shopper has to start off studying from the basics about all the programs and advantages which have been established over in the previous ten years. Medicare Supplement Programs 2021 addresses some medical care costs and solutions that initial Medicare insurance doesn’t include, these kinds of copayments a fixed expense for virtually any programs, healthcare facility deductibles that policyholder pay out of wallet costs, coinsurance is definitely the percentage of taken care of healthcare expenditures from your insurance coverage once you spend your insurance deductibles. There are many programs under Medicare Health supplement as top rated plans are Plan F and program G and more policyholder wants plan F since it covers all of the positive aspects under multi functional Medicare Advantage 2021 strategy at finest costs.

The coverage of the strategies

Medicare Nutritional supplement ideas can far better know with all the maps about its coverage. Supplemental Insurance policy coverage price for your season 2021 will come as much as $70/30 days to around $270/calendar month. Medicare Supplement Strategies 2021 is the perfect intend to conserve the cost over the first Medicare with-inclusive advantages. Medicare health insurance Supplement has higher deductibles for lower fees and minimize deductibles for better fees.

The Medicare health insurance Health supplement prepare differs in ranges as the best plan every year and year 2021 is going to be higher expectations for program F as predicted value. The really reduce Dietary supplement program is plan K, and there are many strategies beneath the Medicare insurance Dietary supplement. The policyholder is exceeding thousands each and every year, as well as the best plan provides the best outcome for that improvement in our well being at an older era and helps to keep your family members in just one umbrella of pleasure.

In the year 2021, Medicare health insurance supplement prepare N will probably be one other popular and handy plan.

This is just because strategy N offers amazing coverage of spaces in Medicare insurance, and has less expensive premiums when compared with Medicare supplement reviews both plan F and G.

This plan N is really a good choice for the coverage, notably if you are emerging off of the Medicare insurance Advantages programs who might well be employed to the reduced rates.

Medicare Supplement Plan N Reviews

Several people signed up for Medicare insurance Prepare N are experiencing the versatility of having no user interface and also the sense to visit anywhere throughout the nation to specialists and physicians that agree to Medicare. This Medicare Plan N doesn’t possess any Highest out-of-the-wallet protection expenses by possibly.

These individuals benefit from the insurance & not forgetting how the Medicare supplement plan N reviews have undoubtedly been excellent. An additional significant thing to observe concerning the Program N is it has a modest level that will grow each and every year than both the Strategy G & F.

Unexpected emergency Apartment Co-shell out

One more contrast with plan N more than G is the fact that whenever you go on to pay a visit to that e . r . you could have the co-pay of around 50.00 bucks when you’re not admitted.

In addition, using the Medicare prepare N, it doesn’t deal with exactly what is named portion B more costs.

They are not too typical and you’d only reach cost them when you look at the medical doctors that don’t agree to the stipulated costs of Medicare health insurance.

It is estimated that more than 95 percentage of physicians in the united states take the assigned rate so with extremely unlikely this’s something you’ll never have to really worry about.

Evidently, Medicare health supplement program N is unquestionably an excellent option for 2021 and afterwards!

Medicare Supplement Plans are insurance plan plans provided by diverse Insurance providers for peopleaged 65 to enable them to in filling up the gaps or say little bills which are not paid by Medicare health insurance. This kind of plans are widely in use at present in most of the countries around the world. To take benefit of this service you need to pay the premium for a certain amount of time. Best Medicare supplement plans are for sale in the marketplaces based on certain requirements Medicare Supplement Plans of the people.

What are the Best Medicare Supplement Plans?

•Plan G

•Prepare F

•Program K

•Plan N

Why are these Plans Very best?

•Program G is better since it has the amount of stuff required in beginning or perhaps not a lot of complications, it is therefore mostly ideal for those newly registering.

•Strategy F is most beneficial mainly because it addresses almost all the stuff within it, it is therefore mostly suitable for people with the condition of the issues in one.

•Plan K is better because it might be easily obtainable in a low budget, therefore it is appropriate for folks who want stuff in accordance with spending budget or at low rates.

•Plan N is advisable since it has got the service of co-spending and quite comparable to program G, so it can be used instead of plan G.

As a result, there are actually four Best Medicare Supplement Plans offered. Away from which Prepare N and Prepare G can be used as choices. It had been expected that the Finest Strategies for 2021 could be G, F, and N.

The Health Care sector is Rising and booming day daily. This really is because of the comprehension of men and women to maintain a secure and healthy existence. For this, several men and women have registered in Medicare programs available in the market. A whole lot of folks uncover these health-care plans a bit perplexing. The Medicare Supplement Plans are more coverage for several of your expense not covered and included in the initial Medicare program. These programs are issued with the national department and lifestyles of a region for those individuals aged 65 and above.

Elements of Medicare

The AARP Medicare supplement certainly consists Of 4 leading components.

These generally include:

Medicare component A: this really is a form of hospital which covers the clinic stays, nursing facility, dwelling in addition to hospice good care of the individual

Medicare Part B: it is a type of insurance plan which covers most of the charges of doctors. These include Services Offered by the physicians and other preventives, healthcare and also the Healthcare equipment required by the individual

Medicare Component C: the plan replaces the initial Medicare in Case the person has registered for or can even be issued as a nutritional supplement for the initial one

Medicare Part D: it belongs flawlessly with the first Medicare Together with Medigap plans taken with most sufferers when some other

Are the plans worth Using?

The Medicare Supplement Plans are really worth taking.

This is because enrolling for an original Medicare without having the supplement will result in an growth in the expenditures and are not of use because most openings are absolutely large and require an alternative of an alternate with it. Moreover, without having needing a supplement plan, somebody has to cover costly deductibles along with 20 percent of the entire health care coverage from their pocket, that will be only of no use.

So, taking Medicare Supplement Plans is Advisable and May be very rewarding to this customer later on.

Medicare supplement plans 2020 are otherwise referred to as as Medigap. It is a really favorable insurance removed from some other companywhich aren’t included from the real Medicaresuch deductibles, so andout of station.Medicare nutritional supplements are not your lone option. Medicare Advantage strategies help along with your Medicare charges, too. Additionally they provide additional wellness addition which Medicare nutritional supplements don’t.

Programs of Medigap:

• Prepare A: This plan incorporates basic benefits to aid with co payments for services covered under Medicare Parts A and B.

• PlanB: Accessible only in Pennsylvania, this arrangement gives indistinguishable advantages from Strategy A nonetheless in addition pays your Medicare aspect an urgent situation clinic deductible.

• Plan F: This structure delivers the best addition of other Medicare Supplement options. It frees all money depending expenditures for clinical costs secured by your Medicare Supplement protection. Starting Jan. 1, 20 20, this arrangement will not, at this time be reachable to people getting recently qualified for addition.

• Approach G: Starting Jan. 1, 20 20, Plan G will be the go-to purchase prepared for fresh Medicare enrollees. It integrates indistinguishable fundamental advantages from program F, including Part B prosperity prices and Foreign Travel Emergency inclusion.

• Prepare N: This really can be our broadly appealing inclusion offering. Back in strategy N, you pay a lesser top quality in return for carrying on a tiny annual payments as well as different matters. This comprises your Medicare Part B co-pays, only as your emergency clinic allowance, co pays and coinsurance.

Picking a plan:

While Selecting a strategy one must be every much attentive and Be more sure regarding the plan packages and the cost of the particular plan.Expenses to get Medicare health supplement safety shift generally.

The 20 20 Medigap Selling Price Index found that a person turning 65 could cover multiple occasions for all intents and purposes indistinguishable inclusion.

Medicare Supplement Strategies are also called Medigap prepare and it is the insurance policy policy which aids the owners to cover all of the coinsurance, deductibles, co payments and excessive charges which aren’t covered below their original Medicare approach. The plan is currently available for anyone that is already registered to your Section A Part B Medicare options. The Medicare supplement plans 2021 is exceptional and has many new upgrades. It insures many of the copayments, extra charges and also foreign crisis traveling for treatment outside the country. Now you could also buy your Medicare Supplements by evaluating the diverse plans from the Medicare Supplement programs Comparison Chat 2021 which can be found on the web.

Fully guaranteed Acceptance

If You’re turning 65 or already above the age of 65, you are ensured Endorsement in some one of the Medicare Supplement Strategies from almost any carrier provided that you arte enroll in just about any of these Medicare Strategies later you turn 65. You want to be certain that you have already registered for Part A and Part B Medicare approach prior to registering to your nutritional supplement plans.

What is Not Covered by Medicare Approach?

The initial Medicare Programs do not insure a variety of healthcare costs Also to pay the expenses that the Medicare Supplement Plans 2021 are launched. It covers all which are not being covered under your initial Medicare program. All-the out of the pocket expenses not included in Part A and Part B have been covered with the supplement plans. Including:

• Aspect B Deductibles

• Element A Hospital Deductibles

• Co Payments for Healthcare Facility Stays

• Care in skilled nursing facility for more than 20 days

• 20% coinsurance for Medical Costs and physician’s statements

Each of the standard nutritional supplements cover these costs and additionally the Cost of foreign traveling for medical treatment away from the country.

A Medicare supplement Strategy Performs with the Absolute Most Essential function within the lifestyles of older individuals. This plan of action is the insurance policy plan. It includes the first Medicare component A and Medical part B in it. When one takes the original Medicare, a few components aren’t covered with it. But Medicare health supplement pays the remaining out portions of this original one.

Each Medicare Supplement plan is determined by a Person’s complete budget savings. Inside this article, we’ll chat about how you’re able to come across the most appropriate Medicare supplement plans 2021 foryou personally.

Know Your coverage, then select the most effective one

Realize That the Medicare Complement strategy will Help the older or those who will simply take it with their money coverage. While the original Medicare will not cover all. Including co insurance, copayments, deductibles, etc..

In the Event You have-

Ø Minimal coverage- You should take Program A. It covers all of fundamental Kinds of substances.

Ø For more protection – You will take Strategy F and G.

Ø Whole protection – Strategies K and L.

Ø National protection – Strategies Do , D, F*, M, N, G.

Locate The optimal/optimally plan based on your financial plan

To comprehend such plans, first, make sure you Understand about your financial plan totally. Then you definitely are certain to get these options rates are set. Three types of price tag processing can transpire.

Ø Age-related- The top pricings come about primarily based on age.

Ø Present age-related- the superior pricing is dependent on the present era.

Ø Group – Members out of an Identical group Must Pay Sam-e The very same value.

Inquire Your own insurance provider about the things they are going to give

Prior to Choosing that Medicare Supplement Options you want probably the most, question around about what they have been offering together with their own plans.

Your Rights

During the Medicare Dietary Supplement open enrollment Period of yours, you can find some good issue legal rights.

Concerning the Insurance business.

A client Should choose the Very Best Insurer for healthcare facilities because you are able to relax and feel free having a responsible company. Accendo insurance coverage is a subsidiary business of CVS Caremark that’s partnered using Medicare health supplement company Aetna. It supplies medical nutritional supplements using a fourteen present household premium reduction in fifteen countries.

These programs assist to cover medical Expenses the original plan does not cover. Depending upon the nutritional supplement program they cover co-payments, deductibles, hospital debts, and hospital maintenance. The provider has more than just one thousand health treatment specialists. They provide the cheapest rate to their customers and provide them the very best healthbenefits.

Great Things about the program G

Program G is a brand new plan That’s lately Introduced in 2020. Accendo Medicare supplement plan G is actually a excellent choice for anyone that see the advantages of the standard plan G attractive but are searching to invest a little less at the monthly premiums. It keeps the month-to-month superior considerably lower than the standard programs. This course of action is for those that just want peace of the mind. Once you’ve paid off your Medicare part B annual deductible all your inpatient and out patient Medicare providers are insured a hundred percentage.

For most people who are turning 65 This plan will offer the best value today. However, there are a number of adjustments and you also should know about these before you choose any decision. This plan has become the most popular supplement plan for clients.

Why the Majority select strategy Y?

In program G from accendo, they’ll cover For that which that a prepare F pays except that the component B deductible at the physician. Plan 5 provides less coverage than approach F. but aim F is way expensive than prepare G. the corporation has altered the premium for approach F. It gives amazing value for the ideal coverage you become.

So together with all the top services and greatest Programs, an individual can choose this insurance policy carrier to conserve cash and secure wellbeing!